2020 ushered in a new era of change for both organizations and individuals; characterized by rampant digitalization, there was also a distinct rise in civil rights activism, particularly pertaining to issues of equality and civil liberty. In the wake of racial justice and environmental protests, individuals asked themselves how they could personally contribute to a fairer, more equitable world.

Enter ‘Impact Investing.’

Impact Investing is the principle by which an individual might be able to make a difference within the confines of personal finance, including both donation and investment. Since Impact Investing was established in 1995, the sustainable investment sphere has exploded in size, growing more than $17 trillion in the US alone. This rapid growth is poised to continue beyond $50 trillion in 2025.

The principles of Impact Investing don’t stop at sustainable fund selection; instead, investors emphasize the role that boards can play in delivering on sustainability promises, lobbying for community change programs, transparency over ESG issues and greater insight into the inner workings of the supply chain, and carbon impact.

Who cares about sustainability?

In a recent survey conducted by EQ, it was found that of those surveyed, 82% of shareholders in the US and UK think companies are responsible for communicating about their ESG activity, but 43% feel that they aren’t doing enough, and a further 34% report intense feelings of frustration when a company behaves unethically- 77% of investors plan to stop buying non-ESG funds completely by 2022.

“ESG will no doubt be an issue on the table at upcoming AGMs and corporate secretaries need to be prepared. Q&A sessions have become such an important aspect of AGMs in recent years (partly driven by digitalization) that managing incoming questions, adding structure to the process and making sure the meeting serves its purpose is now critical.

Hybrid meetings will be key to supporting this in 2022, as instead of putting board members on the spot on the day, shareholders are able to ask questions in advance, giving the board crucial time to prepare a considered response.”

Richard Taylor, CEO

Do investors think big businesses will ‘do the right thing’?

In findings reported by Gallup, support for big business has diminished over the past two decades: in a survey conducted in 1997, 27% of respondents expressed little or no confidence in big business- this increased to 34% in 2019. With changing perceptions of what it means to be a ‘good’ or ‘trustworthy’ business, creating a definition of value is incredibly important. Rather than emphasizing good share prices as an indicator of total value, directors would be wise to take a more holistic view. By committing to an ESG value creation plan, and clearly communicating and reporting on those commitments to shareholders, your organization is better equipped to improve investor relations.

Which topics matters most to shareholders?

Board diversity will be a key topic throughout the 2022 proxy season. In 2021, DEI-related proposals were most prominent amongst shareholders, and received, on average, 59% support. There were similar levels of popularity for reporting on pay, equality and opportunity.

Environmental reporting will also play a key role in 2022. With scientists now advocating for complete net-zero emissions by 2050, there will be a sense of urgency amongst investors to see that progress is being made. During the 2021 proxy season, around 70 shareholder proposals addressing climate risk and opportunities were submitted for meetings through June alone. We anticipate that this will be a landmark issue for many in 2022.

The bend towards ethical business practices is certainly a longer-term concern for shareholders, even if many individuals don’t actively partake in Impact Investing or consider themselves activists in the traditional sense.

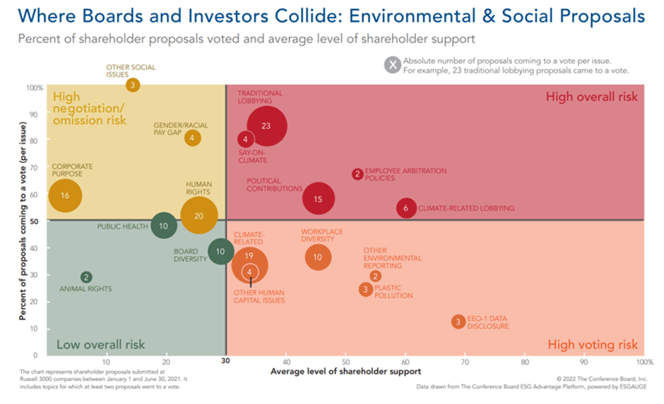

In findings by The Conference Board, E and S were particularly contentious areas of interest, and posed a high voting risk; more investors than ever before want a say on climate, and greater transparency over political contributions to gauge the political leaning and conscience of any given organization.

How can my organization better manage stakeholder interests in ESG?

During the 2021 proxy season, ESG concerns were particularly prominent, and boards were heavily scrutinized by large institutional investors. In 2022 we anticipate that these concerns will be amplified; FTI consulting reported: “Large institutional investors not only backed environmental and social shareholder proposals like never before, but they also voted against the re-election of directors at portfolio companies where ESG management was perceived as ineffective.”

Creating a cohesive Investor Relations plan

Delivering a series of IR events throughout the year is a great way to increase visibility over business practices in the run up to your AGM where the mainstay of voting will take place. Ongoing communication plans can transform your relationship with investors. Providing multiple touch points throughout the year ensures that investor relationships aren’t left to fester, only to overspill at critical meetings. Inviting directors to make regular contact with investor strongholds can enhance voting outcomes, thanks to a better perceptions of transparency and a sense of personal connection with board members.

AGM

AGM

AGM

AGM

AGM | Investor Relations

AGM